Here's your Budget receipt

A caveat-filled attempt to give you an idea of where your tax dollars go.

National made a few headlines recently suggesting that taxpayers should get some sort of “receipt” itemising what their tax dollars are going towards.

The Government alternatively dismissed the idea or suggested this information was already available. It is, but National are right in pointing out that it is not exactly accessible to the average person.

There are a multitude of reasons why an individual receipt would be complicated and probably full of small inaccuracies. This will become obvious below in my attempt to create a receipt for the average Kiwi.

But I do think there is something in the idea of making Government spending more intelligible to voters by bringing it down to the level of the money they pay in. It is well-documented that most people have issues with large numbers, particularly at knowing the difference between say $26m (the price of the flag referendum) and $12b (roughly what was spent on the wage subsidy in 2020). A nice reminder I’ve been using myself lately is that a one million seconds is 12 days. One billion seconds is 32 years.

And so, armed with the actual core crown expenses for 2022 released in yesterday’s Budget, below is a very rough idea of what your income tax goes to. Scroll past all the disclaimers if you just want to see the receipt!

The assumptions and holes in this ‘receipt’

The Government takes in and spends money in a multitude of differing ways that are not that easy to keep track of.

I’ve focused on income tax in this receipt, as that seems to be what National were largely focused on. But income tax only makes up about half of the tax take, with GST and corporation tax picking up much of the rest. These other taxes have an impact on every Kiwi - but they are harder to predict. Would your boss pay you more if there was 0% business tax rate? Maybe? And since the best data we have on expenditure comes from a household survey, it is not simple to estimate what the average Kiwi spends in terms of GST receipts a year.

We do have good data on incomes however, and in June of 2022 the median worker received a pre-tax income of $1189 a week, or $61,828 a year. That means they would pay an income tax total of $11,568 a year, which we will use as our baseline for the receipt.

There are other holes to cover. I have excluded the ACC levy payment from the above for simplicity, as ACC spending is a separate “hypothecated fund” away from the Government’s big “consolidated fund” (it’s a Westpac account!) where most revenue goes into and spending comes from. This is also the case with road taxes which stay in the National Land Transport Fund, which pays for most of our transport infrastructure. Everyone pays into these funds in some ways - even just through buying an item that was delivered by a truck that pays Road User Charges. And to make matters worse regular tax revenue often does make its way into funding these things that are supposed to be entirely funded by levies. But working out the exact amount that an average Kiwi pays in is not simple.

There’s also things that some things missing from the ‘Core Crown Spending’ tables I am using to build this receipt. It is, as you might expect from the name, the core things the Government spends money on day-to-day. It does not include capital spending - think things the Government buys one-off and will keep for a while. But it does cover most of the stuff the Government does.

Your receipt

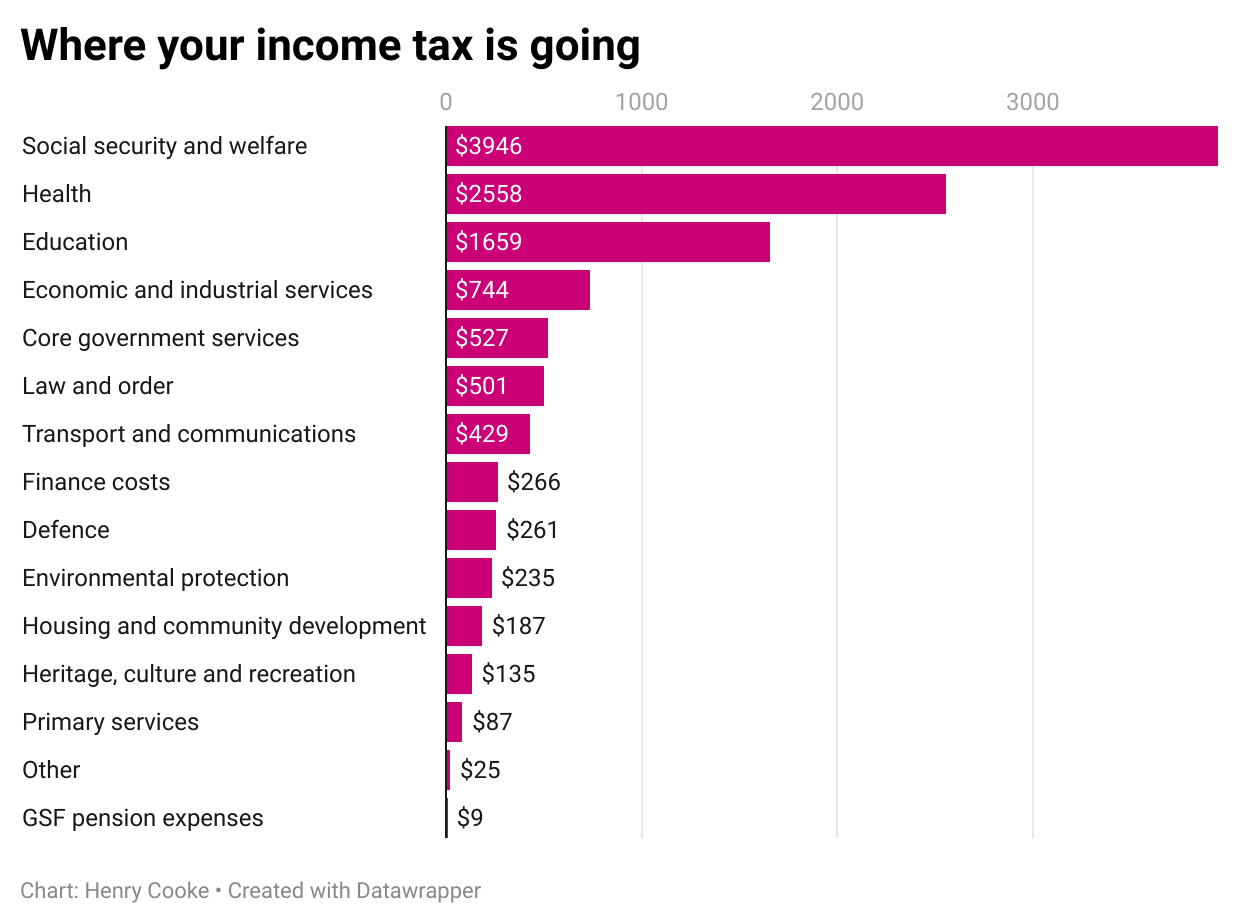

Let’s take that $11,568 in tax revenue and split it up into the core spending the Government undertook in 20221.

Social security and welfare: $3,946.20

Health: $2,557.85

Education: $1,659.41

Core government services: $526.65

Law and order: $501.24

Transport and communications: $428.78

Economic and industrial services: $743.76

Defence: $260.75

Heritage, culture and recreation: $135.16

Primary services: $87.38

Housing and community development: $187.18

Environmental protection: $234.69

GSF (super fund) pension expenses: $8.65

Other: $24.77

Finance costs: $265.54

The methodology behind this receipt, as I explained above, is full of holes2. It should give you an illustrative idea of where the average annual income tax payment goes, but not a definitive one. Here it is as a graph so you can see relative scales:

Much of the tax take (71%) goes toward three big pots - social security/welfare, health, and education. Health and education largely explain themselves (we fund a lot of hospitals and schools) but welfare payments are worth breaking out specifically.

As you can see, superannuation is far away and the biggest benefit, costing the median taxpayer roughly $1600. This single benefit costs more than every other area of Government spending other than health and education.

Other benefits are far from inexpensive. Note the continued cost for the wage subsidy (this was the year to June 2022, so took in a bit of Covid!) and $307 for Jobseeker support. The two payments which most directly deal with the housing crisis - accommodation assistance and income-related rents - each make up a decent chunk.

The family tax credit portion of Working For Families is also not cheap. But the universal benefit we pay to all children under 1 (Best Start) seems pretty affordable when you compare it to the universal benefit paid to everyone aged 65 or over. And the number of people on super is growing - the Government predicts it will reach 987,000 by 2027, up from 848,000 in 2022.

But what about all the new shiny stuff?

Government finances are a huge ship that is generally steered pretty slowly.

The “new spending” announced in each Budget usually makes up a very small proportion of the overall spending governments undertake, because as you can see so much already goes to continued expenses like superannuation and paying teachers. These budgets do announce funding increases for these sectors, which can sound large - but it’s worth paying close attention to these as they are usually spread over four years and sometimes just respond to natural population growth.

As an example, let’s look at one of the headline policies from yesterday’s Budget - the removal of the $5 co-payment for prescriptions. It’s forecast to cost $170m in its first year. That’s not a tiny amount, but for our hypothetical taxpayer in 2024 it’ll be around $14.30. So if they got three prescriptions filled, they’d come out on top.

This also applies for the stuff that makes up a lot of the political discourse, like public servant numbers. Public servants at core government departments cost a non-insignificant $2.5b in 2022 - about 1.97% of core crown expenses or $228 of our median income taxpayers bill. Again, it’s not nothing - but perspective helps.

This is the last year we have “actual” spending for. And it’s the financial year, so it actually ended on June 30 2022. Luckily this is when we have our income data for too so it matches up.

I’ve taken the median amount of income tax paid by a worker and split it by the same ratio that core spending is spending by the Government.

Nz Super should be it’s own category, and then the rest of social welfare could be shown to be lower than a lot of things. I hate how people see “social welfare is our biggest ticket item” and start bagging on unemployed. If it was shown regularly that every year super is our biggest expense, we could start to have an intelligent conversation about putting some restrictions on it (or income testing it!)

This is a great way of explaining in a very simple way public accounting (noting the assumptions make it fairly inaccurate at an individual level). I think it could help build better understanding and perspective around some very political really nothing announcements vs tangible changes (prescriptions charges for example are a fairly cheap in the scheme of things policy for huge net social and health benefits).

I would say, however, that it’s useful when mentioning “public servants” to be more descriptive and add to the discourse to enlighten the general public that human staff employed by the Crown are much much more diverse and wide than people providing say, policy advice to ministers. They could be teachers, nurses, doctors, health assistants, cleaning staff, police, airport security, some defence roles, security intelligence keeping NZ safe to name just a few. It’s very easy for media to contribute to the false narrative that “public servant” spending is solely on those who sit in nice buildings at a desk trying to provide free and frank advice on how to govern in challenging times.